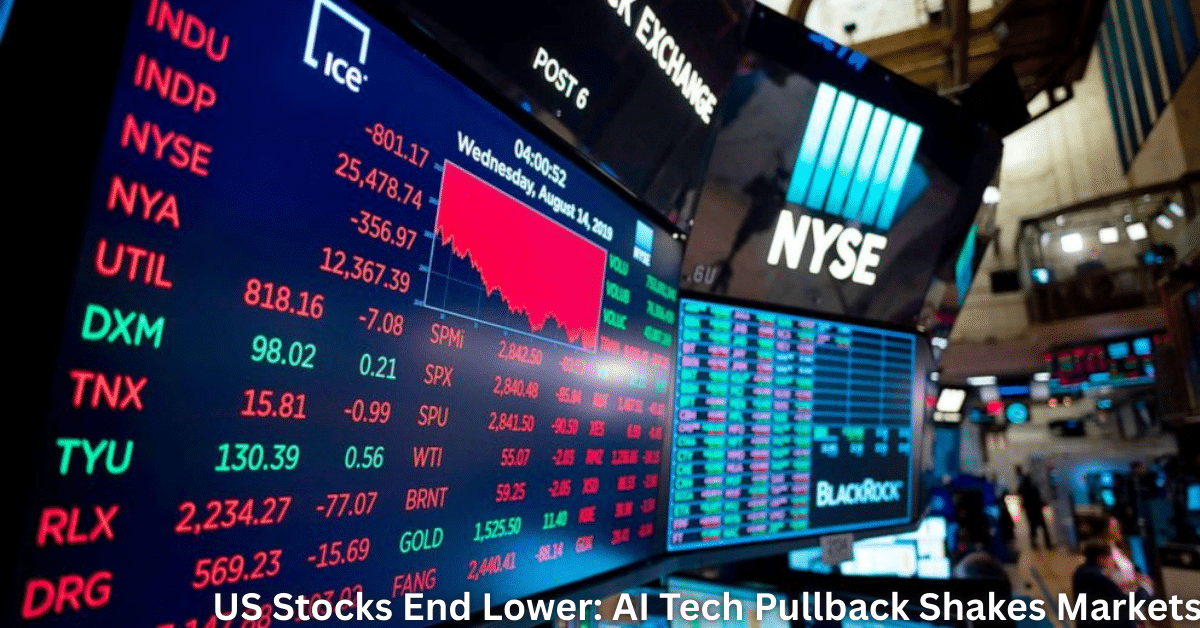

US stocks end lower as a sharp pullback in AI-related tech shares pushed investors to lock in profits after a strong run. Major indexes closed down, with the Nasdaq drop leading the way. This matters because it signals a pause in the AI boom that has driven markets higher for months. Everyday investors and businesses relying on tech sector decline trends feel the impact on portfolios and AI project funding. The rest of this article breaks down what happened, why it occurred, and simple steps to handle the market volatility.

Key Highlights

- S&P 500 fell 1.2% to around 6,721, its worst day in nearly a month.

- Nasdaq composite dropped 1.8%, hit hard by semiconductor stocks like Nvidia and Broadcom.

- Dow Jones dipped 0.5% or 228 points, showing broader Wall Street close caution.

- AI-related tech shares plunged as questions grow over high valuations and slow returns.

- Profit taking investors moved to safer areas like consumer staples amid rising worries.

- Power firms tied to AI data centers, such as Constellation Energy, lost 6.7%.

US Stocks End Lower Amid AI Profit Taking

The session started with hope but turned sour fast. Big Tech earnings from firms like Oracle and Broadcom raised doubts about AI spending paying off quickly. Investors worried that massive investments in AI infrastructure might not deliver profits soon enough.

Profit taking investors saw a chance to cash in gains after records set last week. This created a stock market pullback across AI-related tech shares. For example, Nvidia fell over 3%, while Micron dropped nearly 7%. Such moves dragged the whole tech sector down by 2.9%.

This is not just numbers on a screen. If you hold tech stocks, your portfolio likely took a hit. Businesses planning AI tools face higher costs if funding dries up from investor caution.

Key Stocks Behind the Decline

Semiconductor stocks bore the brunt. Broadcom’s outlook sparked fears of an AI bubble. Oracle’s mixed results added fuel, showing only 17% of big firms are scaling AI projects fully.

Other names slid too. CoreWeave dropped 10%, and SanDisk lost 14.7%. Even power companies expected to benefit from AI data centers cooled off.

| Stock | Decline | Reason |

|---|---|---|

| Nvidia | 3.3% | AI chip demand questions |

| Broadcom | Major drag | Weak outlook on AI growth |

| Micron | 7% | Infrastructure selloff |

| Constellation Energy | 6.7% | Data center hype fades |

| CoreWeave | 10% | Investor pullback |

This table shows how tech sector decline spread quickly. Notice defensive sectors like consumer staples rose 0.9%, as profit taking investors shifted there.

Why the AI Hype Hit a Wall

AI has been the market star, powering gains all year. But now, market volatility is rising. Questions swirl: Will AI deliver real productivity? Can companies handle debt from data centers?

Only a small share of businesses report full AI rollout. This tempers hopes for quick revenue boosts in 2026. Rising Treasury yields added pressure, making tech less attractive.

For AI fans like you, this means rethinking bets. AI-related tech shares may need time to prove value. Check Yahoo Finance for live charts to track shifts.

Broader Market Impacts and Investor Caution

The Nasdaq drop rippled globally. Asian shares followed lower, and Europe felt the chill. Wall Street close volumes hit 18 billion shares, with more decliners than advancers.

Investor caution grew after recent highs. Experts note it’s normal to sell after strong weeks, ahead of jobs and inflation data. Defensive plays gained as tech bled.

This ties into AI business trends. Robotaxis and automation face funding hurdles now. See how at Uber Lyft robotaxi trials for related automation news.

What It Means for Your Portfolio

If you’re in tech-heavy funds, review now. Diversify into staples or energy for balance. Long-term AI believers can buy dips, but wait for clearer Big Tech earnings.

Short-term traders locked profits wisely. Stock market pullback phases often lead to rebounds if fundamentals hold.

Future Outlook: Cautious Optimism

Markets may bounce if inflation cools, aiding rate cuts. But AI needs proof of profits to regain steam. Watch upcoming reports from leaders like Nvidia.

Market volatility tests patience, but smart moves pay off. Stay informed via CNBC Markets for daily insights.

In summary, this tech sector decline reminds us AI growth takes time. Adjust your strategy, explore AI tools for edge, and keep eyes on trends. For more on AI business impacts, check site resources.