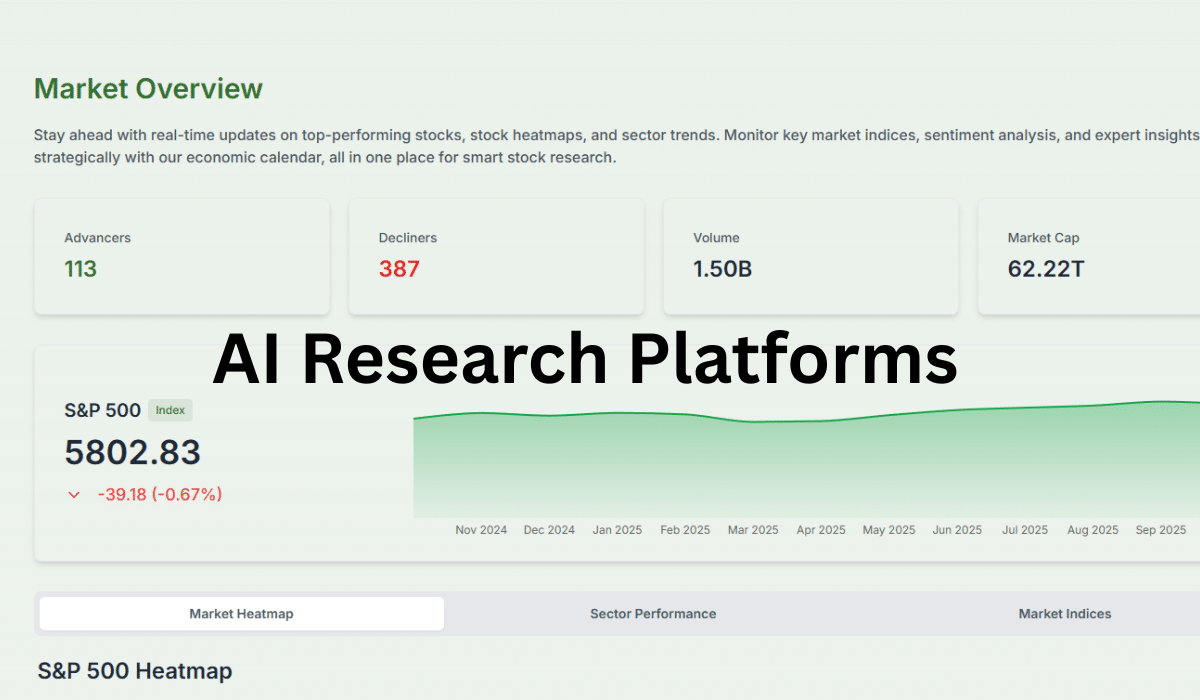

AI tools for stock market research are revolutionizing how investors analyze markets, make decisions, and execute trades with unprecedented speed and accuracy. Artificial intelligence trading platforms now process millions of data points in seconds, offering retail and institutional investors sophisticated capabilities that were once exclusive to hedge funds and professional traders.

Key Insights:

- AI-powered investment tools analyze real-time market data faster than human analysts

- Machine learning stock prediction systems identify patterns across thousands of securities simultaneously

- Automated trading systems reduce emotional decision-making and improve portfolio performance

- Smart trading platforms offer pricing from free tiers to premium subscriptions exceeding $100 monthly

- Predictive analytics investing tools provide backtested strategies with transparent accuracy metrics

- AI stock screeners integrate with major brokerages for seamless trade execution

Revolutionary AI Stock Analysis Platforms

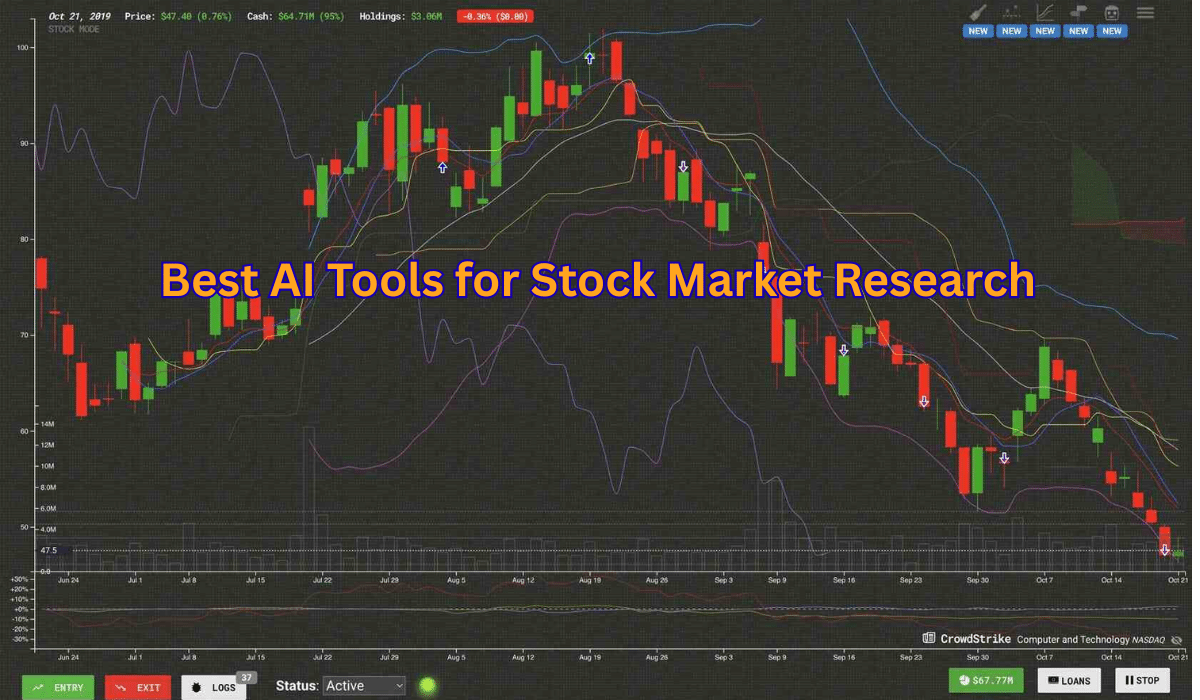

Trade Ideas leads the artificial intelligence trading platforms category with its proprietary “Holly” AI engine that simulates over one million trading scenarios daily to generate actionable signals. The platform processes real-time market analysis across all major exchanges, offering customizable alerts and direct brokerage integration with Interactive Brokers and E*TRADE for automated trading systems execution. Holly’s backtested strategies demonstrate consistent accuracy in identifying profitable trade opportunities, making it the preferred choice for active day traders and swing traders who demand precision. Starting at $118 per month, Trade Ideas represents premium AI tools for stock market research that justify their cost through superior signal quality and comprehensive risk management features.

Tickeron distinguishes itself among AI-powered investment tools by offering versatility across multiple asset classes including stocks, ETFs, forex, and cryptocurrencies through advanced pattern recognition technology. The platform identifies 40 distinct chart patterns in real-time using machine learning stock prediction algorithms, assigning confidence levels to each prediction based on historical performance data. Tickeron’s transparency stands out in the smart trading platforms market, as every AI signal includes publicly audited track records allowing investors to evaluate reliability before committing capital. The platform’s AI Robots feature provides pre-packaged algorithmic trading technology with documented performance histories, while Portfolio Wizards cater to long-term investors seeking diversification. At just $15 per month for entry-level plans, Tickeron delivers institutional-grade predictive analytics investing capabilities at remarkably accessible pricing.

Advanced Technical Analysis Solutions

TrendSpider eliminates hours of manual charting work through automated technical analysis that identifies trendlines, support and resistance levels, and dynamic Fibonacci retracements across multiple timeframes simultaneously. This AI stock screener excels at multi-timeframe analysis, allowing traders to visualize market structure from one-minute charts to monthly perspectives in seconds rather than hours. The platform integrates news sentiment analysis with technical indicators, providing context for price movements and helping traders distinguish genuine breakouts from false signals. Starting at $39 per month, TrendSpider appeals to technical traders who prioritize chart-based decision-making, though it lacks direct broker integration for automated execution and offers limited fundamental analysis tools compared to broader artificial intelligence trading platforms.

Deep Learning Investment Intelligence

Kavout employs sophisticated deep learning algorithms to analyze fundamental metrics, technical indicators, and alternative data sources, generating its proprietary Kai Score ranking system. This predictive analytics investing tool rates stocks on a simple 0-9 scale, synthesizing complex financial data into actionable intelligence that both novice and experienced investors can interpret quickly. The platform combines earnings reports, price history, trading volume patterns, and market sentiment from news sources and social media to identify undervalued securities with strong growth potential. Kavout’s institutional-grade analytics serve long-term portfolio strategies rather than day trading, offering both consumer-facing tools and an advanced Quant Terminal for quantitative hedge funds requiring customizable machine learning stock prediction models with enterprise pricing available upon request.

Emerging AI Research Platforms

Meyka AI has emerged as a comprehensive AI tools for stock market research platform offering real-time insights across global markets with continuous data updates. The platform features an AI-powered chatbot assistant that answers stock-specific queries instantly, from company financials to sector comparisons, providing conversational access to complex market data. Meyka emphasizes Return on Equity (ROE) analysis to identify capital-efficient companies, integrating this metric prominently into its stock screening and ranking algorithms. The platform includes strategy backtesting capabilities allowing investors to validate trading approaches against historical data before risking capital, with a free tier making sophisticated automated trading systems accessible to beginners exploring their first portfolios.

Danelfin positions itself as an AI stock picker designed to help investors “invest with the odds in your favor” through unique data-driven insights and portfolio optimization recommendations. The platform continuously analyzes thousands of stocks using machine learning stock prediction models that score securities based on probability of outperformance rather than binary buy/sell recommendations. Danelfin’s approach emphasizes risk-adjusted returns and portfolio diversification, making it particularly valuable for investors building long-term wealth rather than seeking quick trading profits through smart trading platforms.

AI Tools Comparison Table

| AI Tool | Primary Focus | Key Features | Pricing | Best For | Official Website |

|---|---|---|---|---|---|

| Trade Ideas | Stock Trading | Holly AI engine, real-time scanning, broker integration | From $118/month | Active day traders, swing traders | trade-ideas.com |

| Tickeron | Multi-Asset Trading | 40 pattern recognition, AI Robots, transparent track records | From $15/month | Budget-conscious retail traders | tickeron.com |

| TrendSpider | Technical Analysis | Automated charting, multi-timeframe analysis, sentiment integration | From $39/month | Technical analysis enthusiasts | trendspider.com |

| Kavout | Fundamental Analysis | Kai Score ranking, deep learning, alternative data | Custom pricing | Long-term investors, quant funds | kavout.com |

| Meyka AI | Real-Time Research | AI chatbot, ROE analysis, strategy backtesting | Free tier available | Beginners, global market traders | meyka.com |

| Danelfin | Stock Picking | Probability-based scoring, portfolio optimization | Pricing varies | Risk-conscious portfolio builders | danelfin.com |

Future of Algorithmic Trading Technology

The artificial intelligence trading platforms landscape continues evolving rapidly as natural language processing enables conversational interfaces, alternative data sources including satellite imagery and social media sentiment gain prominence, and quantum computing promises exponentially faster analysis capabilities. AI-powered investment tools increasingly incorporate explainable AI features that reveal reasoning behind recommendations, addressing regulatory concerns and building investor confidence. The democratization of sophisticated automated trading systems through affordable pricing tiers empowers retail investors to compete with institutional players, while integration with traditional brokerage platforms streamlines execution and reduces friction in the investment process.

Machine learning stock prediction accuracy improves continuously as algorithms analyze more historical data and adapt to changing market conditions, though investors should maintain realistic expectations about AI capabilities. No predictive analytics investing tool guarantees profits, and successful implementation requires understanding each platform’s strengths, limitations, and optimal use cases. Smart trading platforms work best when combined with fundamental research, risk management discipline, and clear investment objectives rather than replacing human judgment entirely.

When to Use AI Tools for Stock Market Research

AI tools for stock market research deliver maximum value in specific scenarios. They excel in volatile markets where milliseconds matter, processing thousands of data points instantly for rapid execution. For investors with proven strategies but limited time, automated trading systems execute trades 24/7 without hesitation. These platforms eliminate emotional trading by following programmed rules strictly, preventing FOMO-driven mistakes. AI tools are ideal for backtesting strategies against historical data without risking capital and managing multiple assets simultaneously across diversified portfolios.

⚠️ Important: AI tools complement rather than replace investor knowledge. Continuous monitoring, performance reviews, and understanding underlying strategies remain essential for success.

Market Impact and Stability

While AI-powered investment tools won’t destabilize entire markets, they can create short-term volatility through synchronized reactions. Market safeguards like circuit breakers and regulatory oversight, combined with diverse bot strategies, maintain overall stability. Artificial intelligence trading platforms represent evolutionary progress when deployed with proper understanding.

Critical Considerations Before Using AI Tools

Free AI stock screeners typically include significant limitations requiring thorough investigation. Past performance never guarantees future results—these tools complement human analysis rather than replace it. Essential evaluation factors include cost structures, technical complexity requirements, backtesting capabilities, and alignment with trading styles. Conducting comprehensive research, understanding inherent risks, and investing only affordable amounts remain non-negotiable prerequisites for sustainable success.