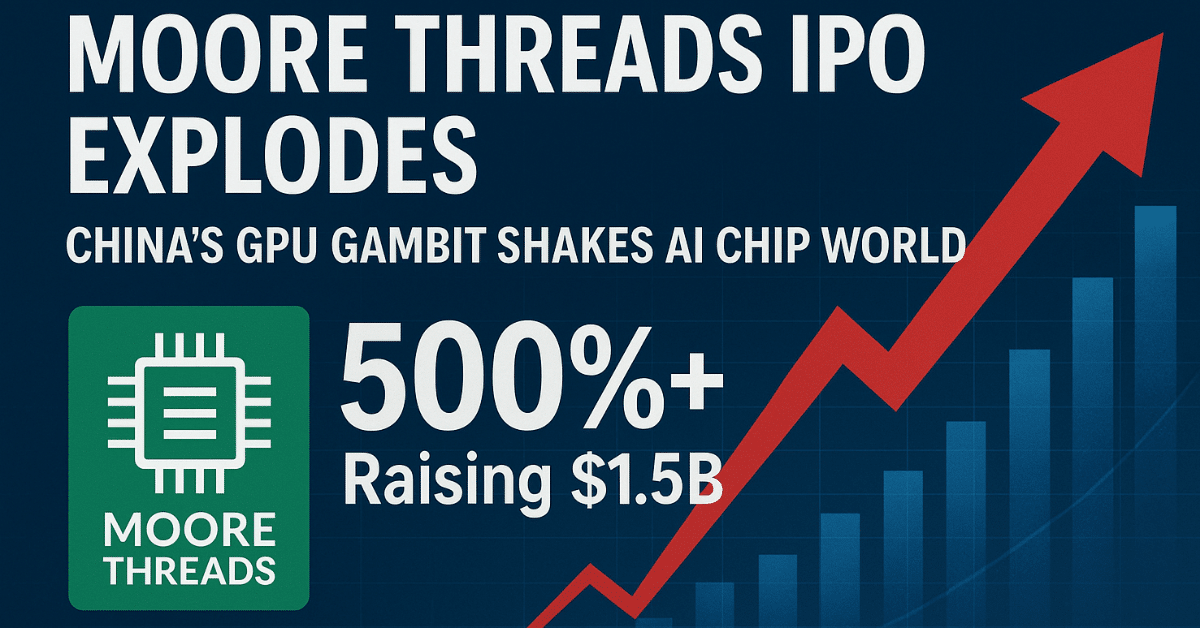

Moore Threads IPO explodes as the China GPU maker surges over 500% on its STAR Market debut, raising $1.5 billion in a blockbuster listing that signals Beijing’s aggressive push for domestic semiconductor self-sufficiency. This AI chip IPO Shanghai event, unfolding December 4-5, 2025, drew bids worth trillions, dwarfing Nvidia’s market cap in frenzy. Amid U.S. export curbs, the meteoric rise underscores China’s quest for a Nvidia China alternative in the red-hot AI sector.

Moore Threads IPO Explodes on STAR Market Debut

The Moore Threads IPO explodes with shares rocketing 469-502% from the issue price on day one, hitting daily limits amid overwhelming investor demand. Founded in 2020, this China GPU maker—often dubbed “China’s Nvidia”—specialized in domestic semiconductor self-sufficiency GPUs like the MTT S4000 for AI training and inference. Its $1.5 billion raise on the Shanghai STAR Market catapults its valuation into unicorn territory, energizing other Chinese chip hopefuls.

- Bids reportedly hit 4.5 trillion yuan (~$630 billion), oversubscribed 4,126 times.

- Early investors from prior rounds saw massive returns, fueling hype around AI hardware independence.

- Trading halted multiple times due to buy limits, a hallmark of blockbuster Chinese tech debuts.

This STAR Market debut not only validates Moore Threads’ tech but accelerates China’s AI chip IPO Shanghai pipeline.

AMD AI Chips China Strategy Counters Beijing’s Push

AMD AI chips China strategy ramps up as CEO Lisa Su signals willingness to pay 15% tariffs for market access, eyeing customized Instinct MI300 chips compliant with U.S. rules. AMD plans a China-specific AI accelerator rollout by mid-2025, navigating geopolitical fallout US-China AI competition amid export bans. This positions AMD against domestic rivals like Moore Threads, blending compliance with revenue potential in the world’s largest AI data center market.

Lisa Su emphasized, “We’re committed to serving China legally,” highlighting modified chips sans advanced features. Yet, AMD AI chips China faces scrutiny as Beijing prioritizes locals, boosting Moore Threads’ momentum. For AI business leaders, this dual-track—foreign adaptation plus homegrown surge—shapes supply chain bets.

AI Memory Crunch 2025 Deepens Amid Chip Wars

The AI memory crunch 2025 intensifies with HBM memory shortage driving prices up 300%, as AI demand outstrips supply until 2027 per analysts. High-bandwidth memory (HBM) scarcity hits GPUs from Moore Threads to AMD, bottlenecking large language models and training clusters. Check HBM memory for AI tools for optimization strategies amid this crunch.

- HBM3E prices doubled in Q4 2025, delaying AI deployments globally.

- China’s self-sufficiency drive exacerbates global strain, prioritizing domestic fabs.

- Forecasts predict shortages persisting through 2026, inflating AI infrastructure costs 20-30%.

This HBM memory shortage amplifies the Moore Threads IPO explodes narrative, as investors bet on scalable AI hardware.

China’s Broader GPU Self-Sufficiency Play

Beijing’s domestic semiconductor self-sufficiency agenda shines through the AI chip IPO Shanghai boom, with Moore Threads leading a wave of listings. As a Nvidia China alternative, its GPUs target supercomputers and edge AI, filling voids left by U.S. restrictions. Explore AI chip self-sufficiency for deeper policy insights.

Implications for Global AI Ecosystem

The Moore Threads IPO explodes convergence with AMD AI chips China maneuvers and AI memory crunch 2025 paints a fragmented yet innovative AI landscape. U.S. firms adapt via compliant tech, while China accelerates China GPU maker independence, pressuring Nvidia’s dominance. For aicorenews.com readers in AI business and automation, this signals diversified sourcing—pairing AMD Instinct accelerators with emerging locals to hedge HBM memory shortage risks.

Investors eye sustained gains, but volatility looms from geopolitics and supply chains. AI tools developers should monitor domestic semiconductor self-sufficiency shifts for prompt engineering and model training efficiencies.