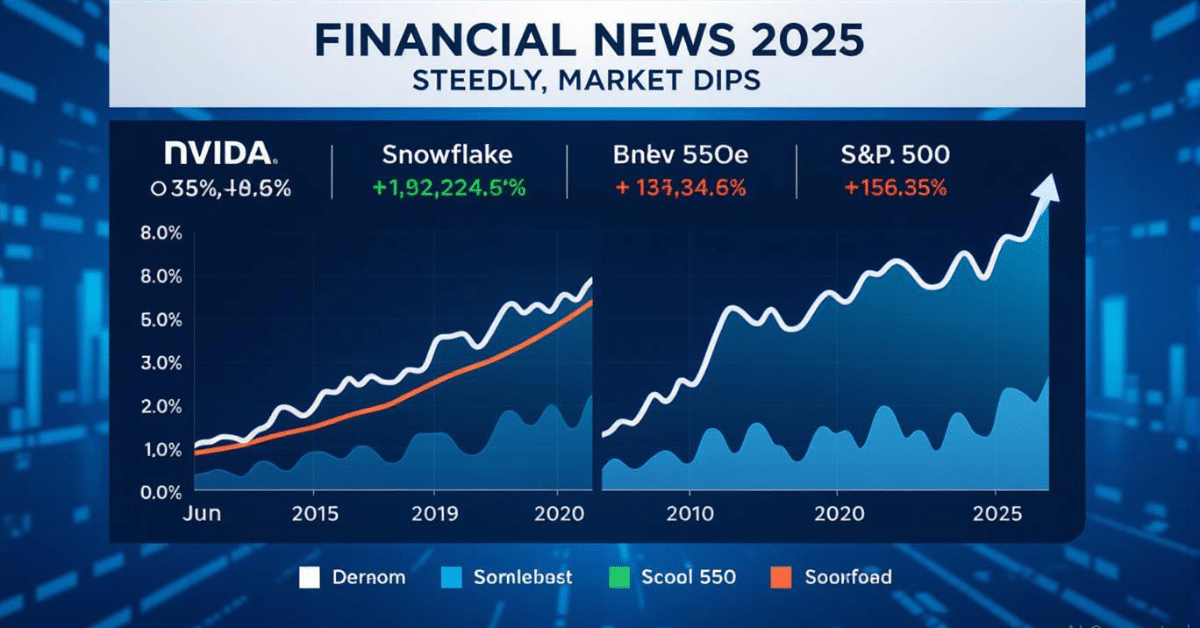

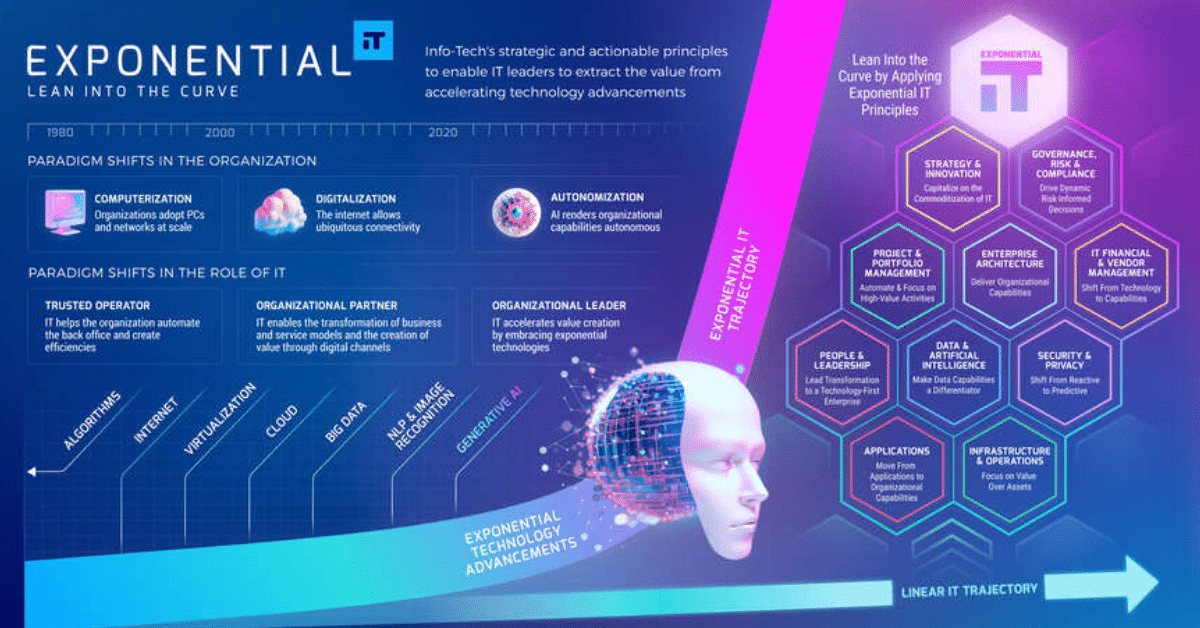

AI stocks bet on future dominance in technology, but current market dynamics reveal a disconnect between long-term hype and immediate realities. Investors are piling into AI growth potential despite warning signs of overvaluation and volatility. This analysis unpacks the trends driving AI stock valuations as of December 2025.

Recent reports highlight how Market FOMO AI—fear of missing out—fuels rallies in hyperscalers stocks like those in the Magnificent 7 AI group, including Nvidia and Microsoft. Yet, experts caution that stock market corrections loom as earnings fail to match sky-high expectations. For AI business leaders and investors, understanding this gap is crucial for strategic decisions.

AI Stocks Bet on Future Amid Rally Risks

AI stocks bet on future innovations overlook today’s shaky fundamentals, with valuations soaring on promises rather than profits. The European Central Bank notes AI rally risks from excessive optimism, where hyperscalers stocks trade at premiums disconnected from revenue growth. Dan Ives of Wedbush Securities warns that while AI infrastructure spending surges, the “picks and shovels” phase may lead to short-term pullbacks.

Jim Cramer recently observed the AI trade breaking up, pointing to profit-taking in overextended names. Reasonable AI stocks, as flagged by Citigroup, offer better entry points—names like certain cloud providers trading at more grounded multiples. This shift underscores why AI stock valuations demand scrutiny beyond headline gains.

- Magnificent 7 AI leaders dominate, but smaller players face higher AI rally risks.

- Market FOMO AI drives 30-50% YTD gains in select tickers, per Wall Street data.

- Investors using AI tools for investors gain edges in spotting undervalued opportunities.

Hyperscalers Stocks and Market FOMO AI Exposed

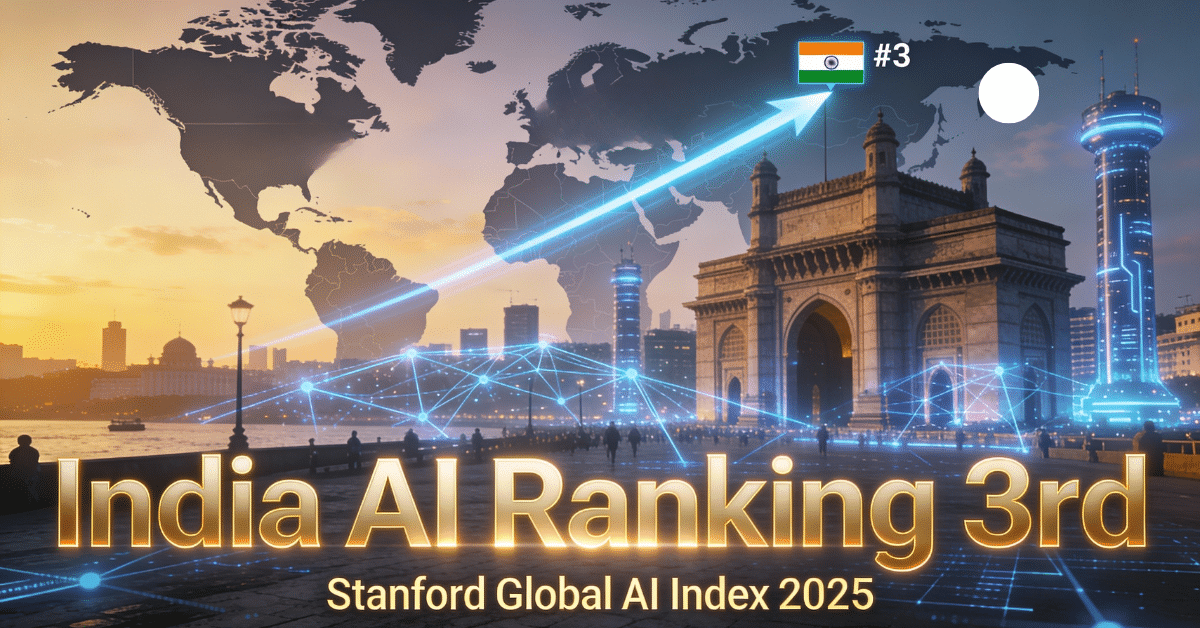

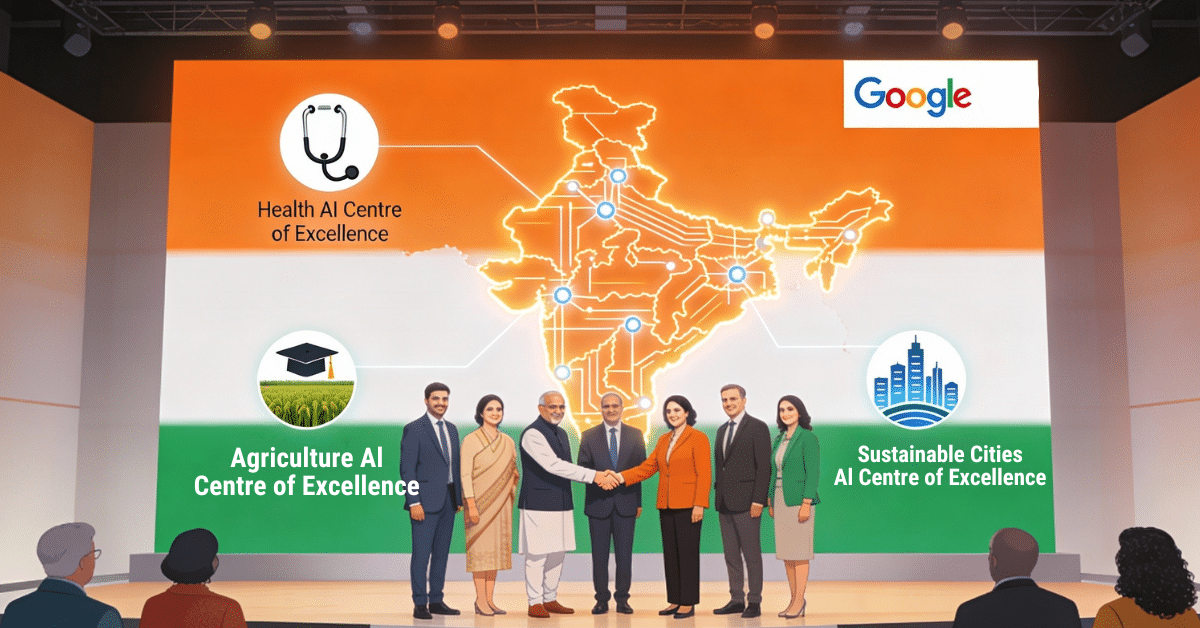

Hyperscalers stocks—Amazon, Google, Meta—anchor the AI growth potential narrative, investing billions in data centers and chips. However, stock market corrections hit when quarterly results show capex outpacing monetization, as seen in recent earnings cycles. Analysts predict a 2026 pivot toward AI applications yielding real ROI, but markets fixate on distant horizons.

AI-driven business growth via enterprise tools could bridge this now-versus-later divide. For instance, generative AI adoption in automation promises efficiency gains, yet stock prices ignore implementation hurdles like high energy costs. Explore AI prompts for trading to model these scenarios.

Citigroup highlights reasonable AI stocks like Palantir and Snowflake, trading at 20-30x forward earnings versus 50x+ for leaders. This disparity signals rotation potential as AI rally risks materialize.

AI Rally Risks and Stock Market Corrections Ahead

AI rally risks intensify with macroeconomic pressures, including rising interest rates and geopolitical tensions. The ECB’s review flags Market FOMO AI as a stability threat, echoing dot-com era parallels where hype outran delivery. Stock market corrections could trim 15-20% from peak AI stock valuations, creating buy zones for patient investors.

Navigating AI Growth Potential in 2025

Reasonable AI stocks blending current cash flow with future upside emerge as winners amid volatility. AI stock valuations will normalize as applications like latest AI news in automation prove scalable. Investors betting solely on tomorrow risk missing today’s adjustments.

Forward-looking strategies emphasize diversification into hyperscalers stocks alongside emerging AI enablers. AI rally risks persist, but AI growth potential remains transformative for business and markets alike.