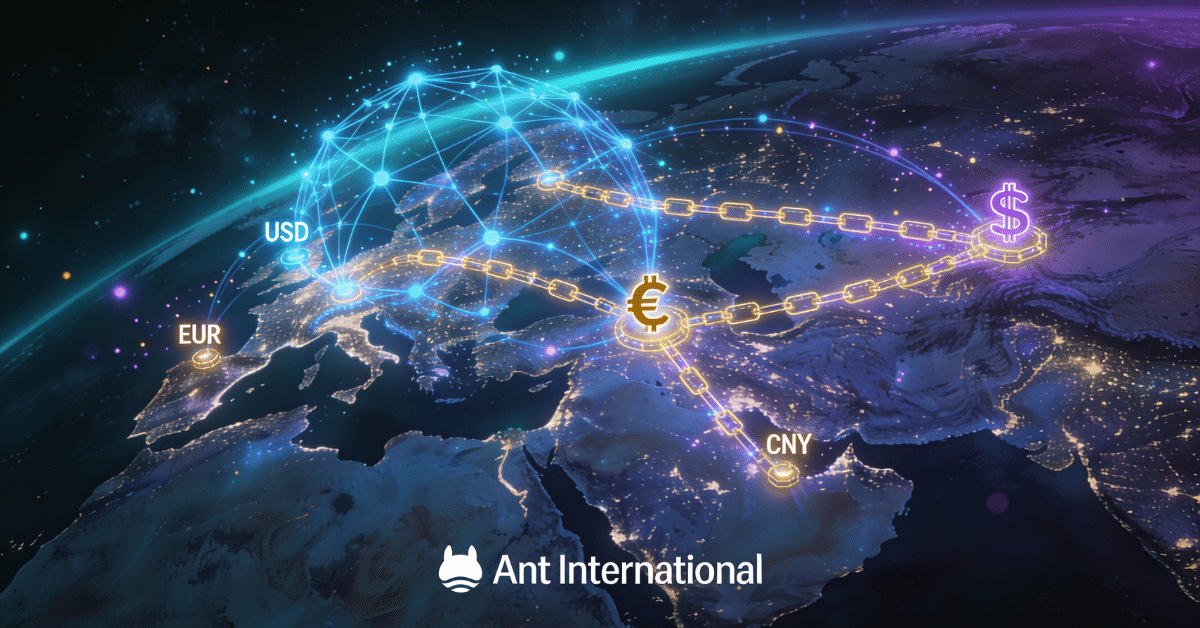

Ant International AI and blockchain initiatives are reshaping how global payments work, blending smart automation with secure digital ledgers to handle massive cross-border flows. Recent announcements highlight their push into AI-powered cross-border payments and blockchain-based payment infrastructure, targeting merchants and businesses worldwide. This comes as the company scales its platforms like Alipay+ and Antom to serve over 100 million merchants.

Key Highlights

- Antom Copilot deploys AI agents for merchant payments, automating everything from FX predictions to settlement approvals.

- Partnerships with HSBC and Swift tested tokenised deposits and digital cash on ISO 20022 networks for faster global transfers.

- AI SHIELD toolkit cuts fraud risks in payment systems, outperforming industry averages in real-world deployments.

- Falcon AI model handles billions in FX volume with 95% accuracy, slashing costs for SMEs.

- Network spans 1.8 billion users via Alipay+ cross-border mobile payments, fueling global treasury management with blockchain.

These developments matter because traditional payment rails are too slow and costly for today’s digital economy. Ant International payment technology steps in with real-time blockchain settlements, enabling instant liquidity for businesses in emerging markets. As trade barriers drop and e-commerce explodes, companies ignoring AI and blockchain in the payment industry risk falling behind—especially SMEs handling volatile currencies.

Ant International’s approach starts with AI agents that act like virtual treasury teams. Picture an AI agent for merchant payments scanning market data, predicting FX swings via the Falcon model, and executing trades—all in seconds. According to company leaders, this tech processes trillions in volume yearly, making AI-powered cross-border payments accessible even to small vendors. It’s not just speed; AI-driven fraud detection and security layers in real-time monitoring to block threats before they hit.

“AI and blockchain will lead the transformation of the payment industry, creating opportunities for SMEs and emerging markets to thrive,” shared an Ant International executive at a recent fintech event.

Blockchain enters as the backbone for trust. Recent pilots with major banks proved blockchain-based payment infrastructure can settle tokenised deposits and digital cash across borders in near real-time. No more waiting days for funds—real-time blockchain settlements mean treasurers get instant visibility. Ant International pairs this with global treasury management with blockchain, where firms pool liquidity on-chain without middlemen eating margins.

Security remains paramount amid rising cyber threats. Enter AI SHIELD, a full-stack defense for financial AI systems. It scans code during development, patrols live deployments, and simulates attacks via red-teaming. In merchant services, this slashed fraud losses below industry norms, protecting Alipay+ cross-border mobile payments at scale. As one report noted, such tools secure everything from chatbots to authorization engines.

“AI SHIELD provides comprehensive protection across the AI lifecycle, helping partners build safer financial systems,” stated Ant International in its launch announcement.

Diving deeper, Ant International AI and blockchain fusion tackles pain points head-on. Merchants using Antom see AI agents handle compliance checks, dispute resolutions, and even supplier payments autonomously. For banks, tokenised deposits on Swift’s network promise interoperability without silos. This matters for the future of digital payments industry, where 24/7 global trade demands zero-downtime rails.

Consider SMEs in Southeast Asia—they juggle multiple currencies but lack big-bank tools. Ant International payment technology levels the field with predictive FX that beats manual trading. Early adopters report 20-30% cost drops, per internal benchmarks. Meanwhile, blockchain-based payment infrastructure ensures atomic swaps, eliminating settlement risks.

Challenges persist, like regulatory hurdles for tokenisation. Yet Ant International collaborates with giants like UBS and HSBC to standardize protocols. Their AI-driven fraud detection and security evolves too, learning from billions of transactions to stay ahead of sophisticated scams.

For more on AI in global payments, check this AI in global payments. And on defenses, see AI security and fraud detection in fintech.

The momentum signals a tipping point. Ant International AI and blockchain won’t just optimize payments—they’ll redefine them as intelligent, borderless ecosystems. Watch for wider rollouts in 2026, as the future of digital payments industry accelerates.