Oracle shares slump AI spending concerns triggered an 11% pre-market drop on December 11, 2025, following disappointing Q2 earnings. The tech giant reported weaker-than-expected cloud revenue miss, raising red flags about ballooning AI infrastructure debt. Wall Street now questions if massive investments in AI data center costs will ever pay off.

Oracle Shares Slump AI Spending: Earnings Breakdown

Oracle’s fiscal Q3 results, released after market close on December 10, showed total revenue of $15.9 billion, missing analyst estimates by $200 million. Cloud revenue miss hit hardest at 8% growth to $6.2 billion, far below the projected 12%. CEO Safra Catz highlighted Oracle AI capex increase to $21 billion for fiscal 2026, up 50% from prior plans, fueling investor AI bubble fears.

The earnings call revealed heavy spending on GPU clusters for OpenAI partnerships news and other AI hyperscalers. “We’re committing billions to AI data center costs because demand is insatiable,” Catz stated, but investors focused on delayed profitability. Shares tumbled in extended trading, with Oracle stock premarket losses hitting 12% in Europe by midday December 11.

Why AI Capex Increase Sparked Sell-Off

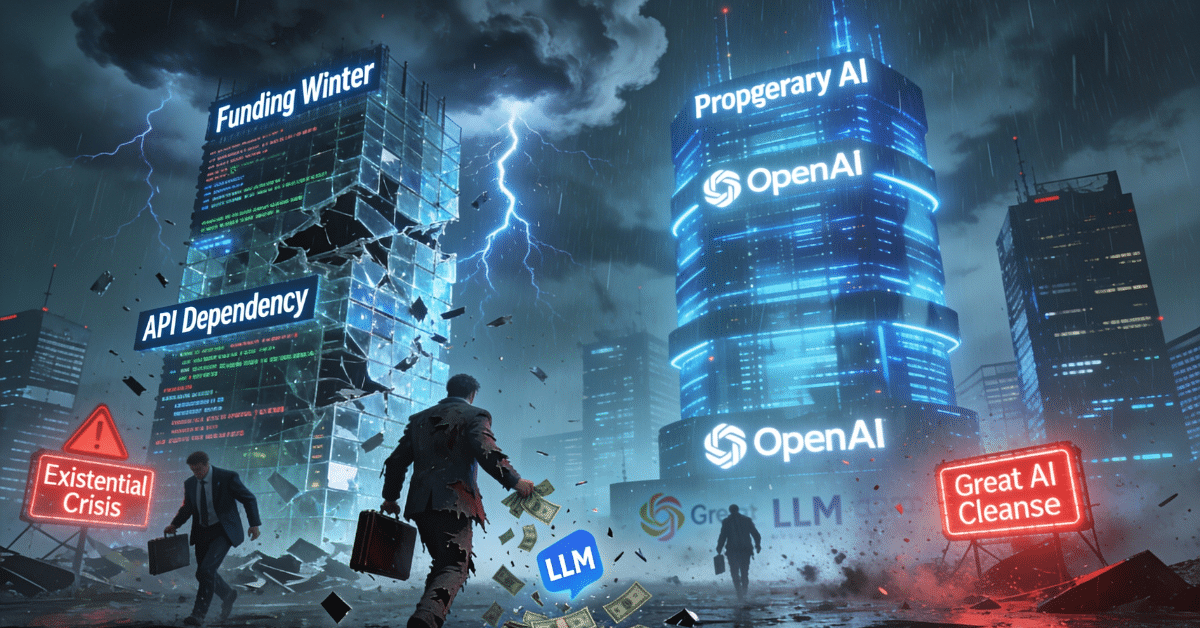

Fiscal 2026 spending projections doubled down on AI bets, including $15 billion for Nvidia chips alone. Analysts worry this AI infrastructure debt—now over $10 billion in capex—mirrors broader tech stock volatility in the sector. Oracle’s cloud unit, once a growth engine, now faces margin pressure from AI data center costs outpacing sales.

- Earnings call highlights: Guidance cut to 15-18% cloud growth amid capacity constraints.

- Investor AI bubble fears: Comparisons to dot-com era, with returns expected in 2-3 years.

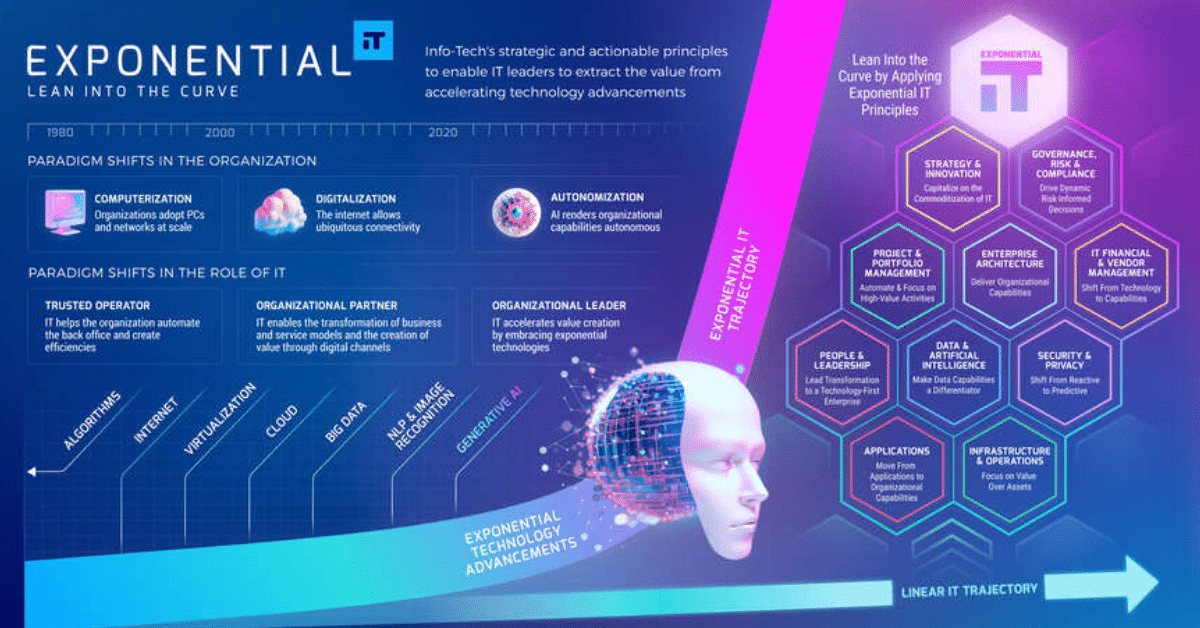

- Ties to AI infrastructure investments reshaping enterprise tech.

CFO Mike Sicilia noted, “Our Oracle OpenAI deal secures long-term capacity, but short-term dilution is real.” Yet, free cash flow dipped 20% to $2.1 billion, amplifying concerns.

Broader Cloud Revenue Miss Impact on AI Sector

Oracle joins peers like Microsoft and Amazon in facing scrutiny over AI capex increase sustainability. While Oracle stock premarket rebounded slightly to -9% by U.S. open, the episode underscores tech stock volatility. Investors fear an AI bubble if AI data center costs don’t translate to revenue soon.

Explore AI tools for stock analysis to model similar scenarios. Oracle’s pivot to sovereign AI clouds in Europe adds upside, but earnings call highlights stressed execution risks. Check Oracle Investor Relations for full transcripts.

Oracle’s AI Strategy Amid Investor AI Bubble Fears

Despite the rout, Oracle touted 40% growth in AI-related cloud services. Partnerships like Google DeepMind AI research and Oracle AI automation trends position it for recovery.

In summary, while cloud revenue miss drove the immediate Oracle shares slump AI spending, long-term AI infrastructure debt bets remain intact. Stay tuned to AICoreNews for latest AI industry earnings.